Your Taxes. Your Voice. Your Friends School.

- UFS Editorial

- Oct 24, 2025

- 5 min read

Your taxes can do more than pay a bill; they can open doors for curious, compassionate learners. Learn how the EITC program helps more children experience the transformative power of a Quaker education at UFS.

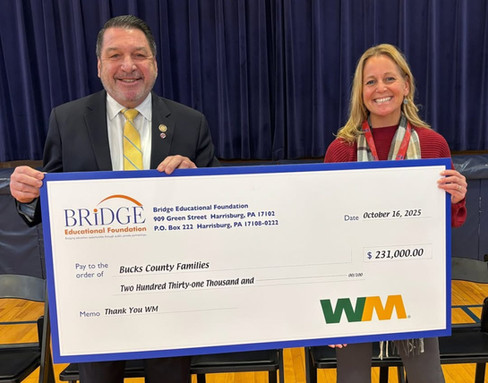

This fall, United Friends School had the honor of welcoming Pennsylvania State Representative Craig Staats to our campus. Rep. Staats visited to learn more about UFS and the amazing work we do in providing educational opportunities for families in our community.

During his visit, Rep. Staats toured classrooms, met with students and teachers, and saw firsthand how EITC contributions directly benefit local children. We appreciated the opportunity to share our school’s mission and to demonstrate the real impact of this important state program.

A Program That Keeps Giving Back

Through Pennsylvania’s Educational Improvement Tax Credit (EITC) program, individuals and businesses can invest in United Friends School students using their Pennsylvania tax dollars and receive a 90% state tax credit in return.

Here’s how it works:

Open to PA individuals or businesses with state tax liability

90% Pennsylvania tax credit, plus potential federal deductions

Instead of sending your tax payment to Harrisburg, you can keep it local, helping students in Quakertown grow, learn, and thrive.

As Rep. Staats noted during his visit, programs like EITC make it possible for families to access learning environments that best meet their children’s needs.

Why It Matters

At United Friends School, EITC contributions create opportunities for families seeking a Quaker education who may lack the resources to afford one. Every dollar helps foster an environment where children are recognized, valued, and supported by nurturing teachers. Your EITC investment gives UFS students access to a Quaker education that fosters:

Curiosity, compassion, and confidence

Experiential, project-based learning

STEAM and arts exploration

Leadership and initiative

One alum family recalled their own journey:

“When we began at UFS, we needed support in order to send our daughter there, but we were committed to ensuring she had an excellent foundation to her education. When we were able to support the good work of UFS on a daily basis for students and the world beyond the school, we were happy to ensure that other families would be able to send their children to UFS.”

Another family shared:

“We were part of the community from preschool through the end of middle school, so much of our memories of our daughter growing up are intricately connected to UFS. Our daughter connected so well with the adults she encountered, which I think is unique in a place where teachers are so involved with the same students for years.”

These testimonies capture what United Friends School is all about. The EITC program has enabled generations of children to be part of this community, where learning extends beyond academics to include compassion, stewardship, and the courage to act with integrity.

Compassionate and Thoughtful Leadership

Every contribution through EITC ensures that more students have access to this transformative education, rooted in peace, integrity, and community.

Recognized Across the Commonwealth

Governor Josh Shapiro recently recognized United Friends School for its commitment to nurturing independent, confident, and compassionate students. In his letter, he commended the staff for helping children reach their full potential and expressed confidence that the school will have a positive impact on the Commonwealth for years to come. This recognition reinforces what our families and community know: the values of simplicity, peace, integrity, community, equality, and stewardship at UFS are shaping the leaders of tomorrow.

One parent shared:

“Our son started in preschool seeking more outdoor learning and creative, project-based experiences. UFS made this possible through financial aid, shaping his love of learning and confidence.”

Business Partnership Benefits

Businesses that invest through EITC not only support students but also demonstrate their commitment to our community’s future. The Friends Collaborative recognizes its business partners through the Business Partnership Program in meaningful ways. Learn more about the Business Partnership Program by clicking here.

Investing through EITC keeps tax dollars local, creates real opportunities for students, and connects your business to a mission rooted in peace, learning, and leadership.

Learn More: The Friends Collaborative EITC Information Sessions

To make participation simple, The Friends Collaborative, a partnership of Pennsylvania Quaker schools, is hosting EITC Information Sessions for individuals and businesses who want to learn more:

Monday, October 27, 2025, at 6:30 PM

Tuesday, October 28, 2025, at 12:00 PM

Business-focused session: Thursday, November 6, 2025, at 11:30 AM

These sessions will walk you through how to redirect your Pennsylvania tax liability into scholarships that help students attend schools like UFS.

If you can’t make it or missed the dates, please contact Amy Wall, Advancement Director, to receive a recording of the information session or to schedule a private info session.

awall@unitedfriendsschool.org or call 215-538-1733 x107.

How to Invest in United Friends School Through EITC

Getting started is easier than you might think!

Here’s the process:

Determine Your PA State Tax Liability

Use The Friends Collaborative's Tax Credit Estimator to check your contribution amount.

Provide Your Information

Individual donors: Name, preferred name, credit amount, single/joint, email, and 1- or 2-year agreement

Businesses: Legal business name, tax ID, contact name & title, email & phone, credit amount, and 1- or 2-year agreement

Sign Your Agreement

You'll get your EITC agreement from The Friends Collaborative to review and sign, choosing United Friends School as your recipient.

Submit Payment

Payments are processed automatically every 10 days after signing.

Done!

The Friends Collaborative will finalize the agreement, and you’ll get a copy for your records. You’ll also receive your K-1 for tax purposes on March 15.

It’s straightforward and efficient: your contribution directly supports UFS students!

Your Gift, Their Future

At United Friends School, we believe every child deserves to be seen, supported, and inspired to make the world a better place. When you participate in the EITC program, you turn your tax dollars into a direct investment in local students, helping them grow into confident, compassionate, and capable leaders.

As one alum family shared, “Supporting UFS is supporting a mission devoted to cultivating critical thinking in students and peace in the world. If we can be a small part of opening access to a UFS education to other families, then it is our honor to be part of such a mission.”

Redirecting your taxes has never been so meaningful or so close to home. By choosing to invest in United Friends School through the EITC program, you’re ensuring that more children in our community can experience the lifelong gift of being truly seen, supported, and inspired to make the world a better place.

At United Friends School, your contribution doesn’t just educate a child;

It strengthens a community.

Invest in UFS.

Invest in Our Community.

Invest in the Future.

.jpg)

Comments